Land Revenue system of Delhi Sultanate by Harsh

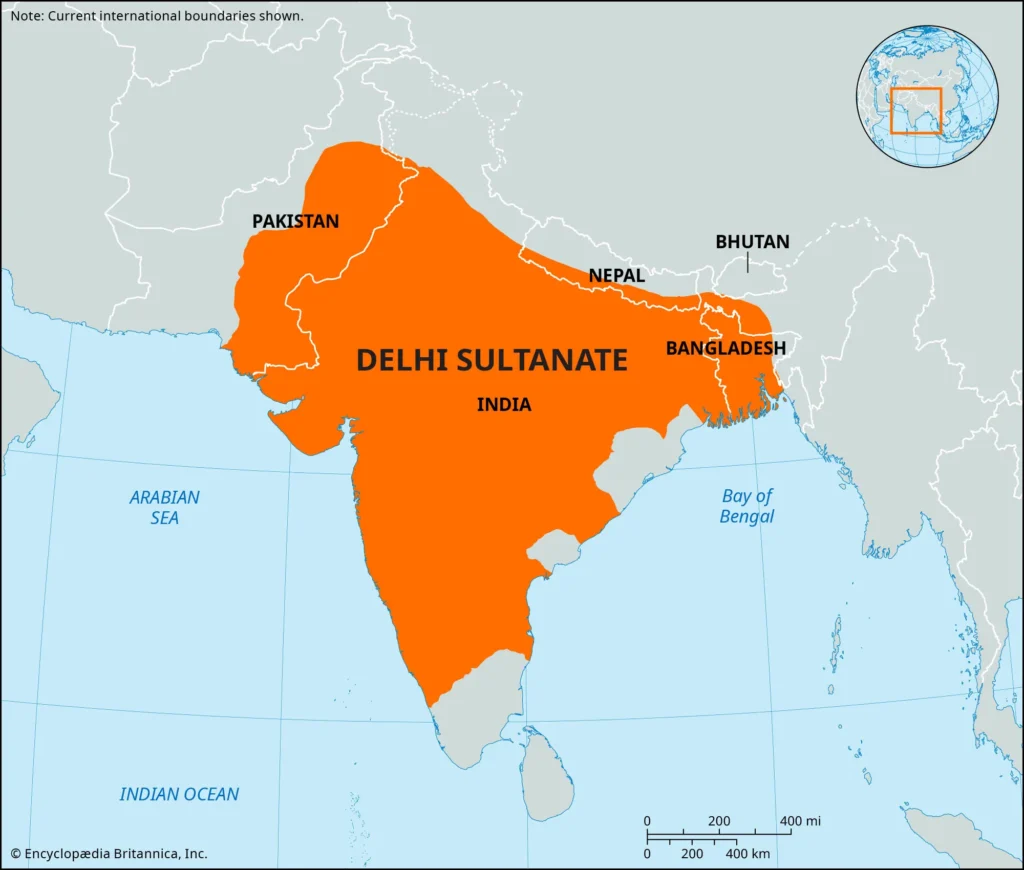

The establishment of Turkish rule in India during the last decade of 12th century AD, marked the beginning of new phase in Indian history because for many centuries hereafter India was ruled by Turko-Afghan rulers. This came to known as Delhi Sultanate. Turkish rule was started in India after the defeat of Prithviraj Chauhan in the second battle of Tarrain, c. 1192 AD. Before that, their rule was limited to north-western parts of India. Turkish rulers brought number of changes in technology and economic activities as well. During this age number of changes were made in the land revenue system.

Also Read : Deccan Policy of Early Mughals

Deccan Policy of Later Mughals

Religious Policy of Emperor Akbar

Land Revenue System of Early Phase of Delhi Sultanate

After establishing Turkish rule, early Sultans maintained status-quo in many spheres of Sultanate. The same approach was adopted by them in revenue system. They didn’t try to changes the taxation system because the foundation of Sultanate was not that strong at time. Thus, any kind of interference in the system can triggered a revolt in sultanate.

During early phase Batai or crop sharing was the most common was the most common system of the assessment of the revenue. In this system, the production was shared between peasants and state in a definite proportion. The common share was taken by state as revenue was 1/3rd of the production. Khut or Muqaddam was responsible for the collection of revenue, who was also the head of village.

These Khut or Muqaddams were worked as intermediaries or link between state administration and peasants. And they were freed not to pay tax for their own lands. They were also entitled to collect some cesses from peasants for their own use. This special right was known as Haqq-i-Khoti and Kismat-i-Khoti.

It was Sultan Alauddin Khilji who took number of steps to reforms the state system including the taxation system.

Land Revenue System of Sultan Alauddin Khilji

Revenue reforms formed important part of efforts made by Alauddin to consolidate his authority and to eliminate the all-possible challenges. He introduced these reforms to consolidate the extra wealth lying with intermediaries, peasants and common peoples. The other main reason was to maintain a large army. He initially introduced these reforms in Doab region.

The Doab region (the land between river Ganga and Yamuna) was chosen because it was located close to capital, so he could inspect the implementation of reforms himself. And intermediaries were stronger in Doab region. He introduced a new system of land tax assessment known as Masahat, was developed. In which, the revenue was assessed through the survey and measurement of land.

The rate of land revenue was increased to 50% from the previous 33% of the produce. New tax known as Ghari (house tax) and Charai (grazing tax) were introduced. The privileges enjoyed by intermediaries were taken away. They were ordered to pay land revenue at normal rate. Extra tax was collected from peasants for their own use. Haqq-i-Khoti and Kismat-i-khoti were abolished.

After these reforms the reforms of Alauddin were continued by his successors with some changes and modification.

Pingback: Land Revenue System of Sher Shah Suri - historylover.in

Pingback: Ain-i-Dahsala System – Akbar’s Land Revenue System -

Pingback: Mughal Empire – Technological Progress-historylover.in